You have researched how to budget and save money as a student, but everything sounds confusing? Well here is my easy guide for you!

I have been budgeting and saving my whole life since my parents raised me that way. But I know not all students have the same kind of family, so I wanted to share everything I know about how to budget and save money as a student.

Wanna save up for Christmas? Read How to Save Money for Christmas here!

Table of Contents

How to Set a Budget

Here is step 1, and no it isn’t hard! I actually like setting budgets because it makes me feel super organized and I like to have my life together. You will too! And it’s okay if it takes some time to figure out what works best for you.

How to create a List of Expenses

I do this at the beginning of every year (you should right now if you haven’t yet!). I write down everything I need to spend money on, so everything you need. If you live at home, that list is pretty short, so use that to your advantage and save more money as long as your expenses aren’t high.

Examples are:

- Phone bills

- Food

- School supplies

- Tuition (for college students)

- Transportation (car, train, bus)

- Insurance/ car insurance (if you pay that yourself)

- Medicine

- Clothes & Hair/Skin products (necessities)

As you see again, if you’re living at home, your expenses are at their lowest! Use that to save more money from your income, which we will get to right now!

How to create a list with your Income Sources

Knowing where you get money from is something not many people mention. It helps you organize and track your financial situation better, which we’ll get to the section “track your spendings”.

Examples are:

- Monthly money from parents

- Work

- Selling things

List how much money you earn on average each month, and compare that number to your monthly expenses. Does it cover the expenses? Is it much higher? Or even lower?

It is super important to know where you stand financially. You will always want your income to cover and exceed your expenses, so you can eventually become financially independent and avoid living paycheck to paycheck.

Here is an example:

If you earned $700 last month and your expenses were… let’s say $400 total. You’d have $300 plus you can split into the following:

- Savings account

- Emergency account

- School account

- Spendings account/fun

You can have more or fewer categories, but these are what I work with currently.

At the beginning of the year, I set what percentage of my spendings will go into each account. You can also keep it in envelopes if you prefer cash.

That helps me set my goals even better and avoids being confused each time I want to put money in my savings, which for me is once a month.

Emergency Account

This account, you. cannot. touch.

Like the name says, money in here is for emergencies and unexpected spendings you’ll need sometimes. I usually put 10% into this account as a student.

What you would spend money on from this account would be:

- Accidents

- Illnesses

- Anything your insurance refuses to pay

Later, you can either keep the account for emergencies or take the money for your first apartment/house or towards rent.

Savings Account

This account/envelope holds my money I am saving up for certain financial goals. That way, I know my goal and I’m more motivated to save money. Depending on how fast I want to achieve my goal, I save 20-30% into this account.

I am saving for a car right now, but other ideas would be:

- New phone

- An apartment

- New furniture

- Donations

School Account

For both, High School and College students, I would recommend putting money into a “school account”.

Before I started college, I put away 50% into that account. That is a lot, but based on your priorities, you can set that amount lower. I would recommend keeping it at least at 20% though.

Spendings Account

This is going to be your “fun” account, where you put everything that is left after your expenses and savings. I would recommend 20%, but just like the other accounts, that is totally up to your preference.

Things you can spend this money on is everything you want but not necessarily need. That could be:

- Entertainment

- Any subscriptions like Spotify, Netflix, etc.

- Going out

- Shopping (other than your necessities)

- And more

How to track your Spendings effectively

Tracking is everything, guys! You have to know where you stand in order to stay on track with your budget. Here is a budget tracker for free:

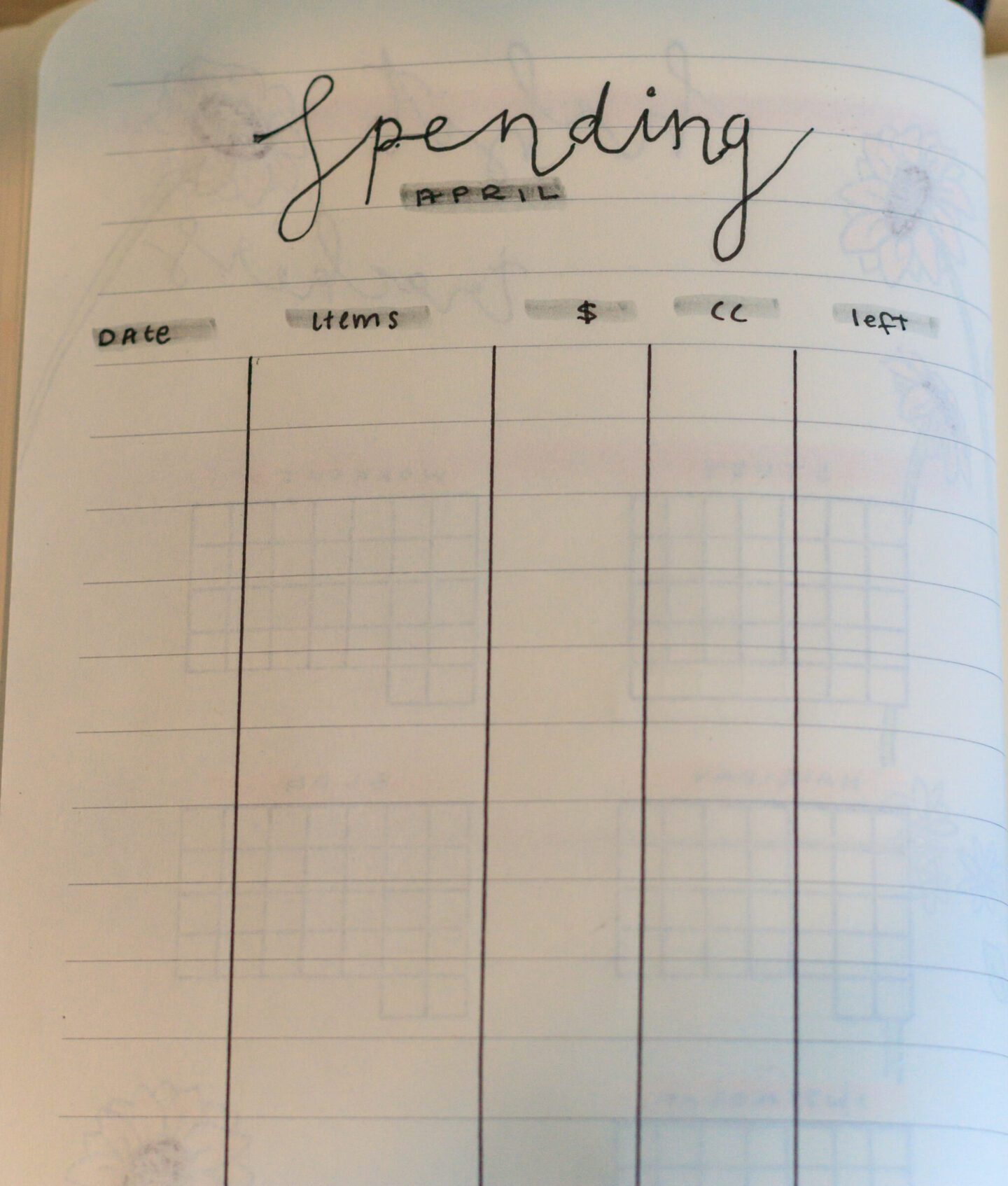

You can also keep a spendings tracker in your bullet journal, like this one

to help me track everything I spend money on and to see how much is left for me to spend.

What goes on there is everything you spend money on, which is your “expense list” and the “spendings/fun account”. If you spend from your emergency, school, or savings account, write that down too but mark those in other colors.

How to: Monthly Review

What I do at the end of the month is to count my spendings from my bullet journal spread together, and write down how much money CAME IN that month. You can also keep an income tracker if you’d like.

You can then compare how you did that month. Here are a few scenarios:

- Expenses are higher than income

- Income and expenses are equal

- Income is higher than expenses

Obviously, the last one is our goal, so let’s take scenario #1. If your expenses exceed your earnings, you need to first take a look at your expenses, and try to find a pattern over the next few weeks and months.

Are you spending money on “want’s” instead of “need’s”? Or was it just a special month where you had to spend more than usual?

How to solve it:

- Cut down on things you spend money on (we will get to tips later on)

- Build up your emergency account for months you need more money in

- Increase your income to exceed your expenses

If you are scenario #2, you’re on the right path, but should change some things to escape the existence-based lifestyle.

Here is what to do:

- Look where you can cut down on expenses

- Increase your income

- Save everything that’s left after your monthly expenses (necessities)

For #3, that’s awesome! what to do next:

- You should focus on saving the money that you have left after your necessary expenses to build up your accounts

- Look for ways to increase your income

Now you know how to budget and save money as a student, and all you need to do is to stick to your budget! That is super important to be successful with saving money.

Now, let’s get to my tips.

Money Saving Tips

- Look for scholarships for college

- Use student discounts (if you need what the discount is for)

- Rent your textbooks or get them from others. Don’t buy them new!

- Thrift your clothes. Thrift stores are awesome and can save you hundreds of bucks each year

- Cook yourself if you have the opportunity

- Plan your meals. It is going to save you so much money when you shop for your meals

- Social activities don’t cost money

- Do challenges with friends, like who spends the least, who can plan the night out, etc.

Money Making Tips

I have made a few blogposts for making more money for students, they all have valuable information and really good ideas!

- 15+ Ways to Make Money as a Student

- 12 Websites that pay $20/hour to Students

- How to start a Blog as a Student

- Free Blogging Course for Students

In conclusion

So basically you have your necessary expenses and the 4 accounts, every time you earn money, best is once a month, you divide your income into these 5 streams. If you can’t even cover your necessary expenses, or can barely cover, read the saving and money-making tips to cut down on expenses and increase your income.

I hope this budget and save money as a student guide helped you give a few ideas on how to tackle your finances a student, whether you go to High School, College, or are working.

If there is anything you are still confused about, please let me know so I can help.

Until soon,

[…] How to Save Money and Budget as a Student […]