You want to start budgeting your money but not sure how to get started? Today’s post is about how to use a budget planner!

In my previous posts about budgeting for students and managing money in college I shared tons of tips for budgeting, including using a budget planner!

Well, in this post we are going to cover how to actually use one efficiently.

Let’s get started!

First of all, you need to have a budget planner. You can either make one yourself on excel or google spreadsheets or in your physical planner, or, get my free budget planner and tracker below!

1. Download the Budget Planner

It’s super easy: Just sign up above and get the printable straight to your inbox! Then, you can print it out and put in your numbers as we will just talk about.

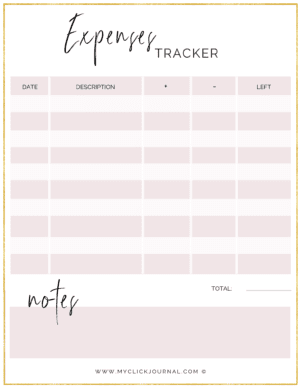

2. The Expense Tracker

The expense tracker is one of the most important parts of how to use a budget planner and is one of my favorite tools to efficiently budget your money!

In order to know how much you have to spend each month, you need to write down what you buy and how much it costs.

For this page of the printable, you write down the date of your purchase or incoming money, the description of it (what it is basically), and how much it cost.

You can see that there is a + and – section. If you have money coming in, you write it into the + section, and if money is leaving your account (you purchase something), you write it to the – section.

Lastly, you write down how much money is left in your account in the section “left”. That’s it!

Don’t forget to calculate the total amount you spent in that month – yes this is a monthly expense tracker – so that you can easily refer back to it when you’re doing your year review and want to know how much you spent the whole year!

Related Posts:

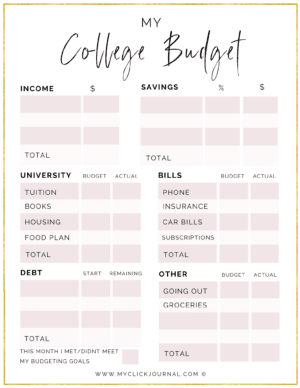

3. The Budget Planner

Now let’s get to the actual budgeting! In order to know how much money you have available every month, you need to figure out how much you make or how much money you get every month, and then deduct the money you spend.

In the top left corner, you can add the money you make every month, or expect to make that month.

On the top right, you add how much of that income goes straight to savings! For example, you can add 10% to your emergency savings every month. That’s what you write down, including how much that is.

From there, you then have the amount you can use to pay for your day-to-day expenses such as bills, housing, food, tuition, and more. I know, tuition is usually paid for before college starts, but in case you’re on a payment plan it’s good to add that to your budget.

You see that there are 2 categories for what you spend money for: university and bills. University includes anything you spend on college, while bills are general things you’d pay for anyways, such as Amazon subscriptions, car insurance, etc.

You can also add your debt if you have any, and also fun expenses you spend money on regularly.

At the end of all that, you calculate how much money you have left. That money is either spending money or you can save it to go towards a new car, camera, your future apartment, etc.

4. Budgeting Tips

Here are some tips for having more money left at the end of taking off all those expenses!

Cut your expenses

Do you really need Amazon prime? Do you actually use that other subscription you have? If you don’t use something regularly, cut it!

The more expenses you can cut, the more money you have left at the end!

Maybe you can switch your phone plan to a cheaper option, or use less water and heating in your apartment to cut your utility costs.

Increase your income

Cutting expenses can only get you so far. You can’t cut out everything from your list! That’s why increasing your income is a great way to have more money left after deducting your expenses.

You could take on a campus job such as tutoring or being an assistant to a department, create your own side hustle (walk dogs, sell clothes, sew things for others,…), or even start your own business.

I started a blog and Youtube channel, and it has really increased my income and I can put much more money towards my savings now.

Last Thoughts

Budgeting in college isn’t easy! But I hope this post about how to use a budget planner really helped you get a better idea of HOW to budget.

Don’t forget to download it here:

Until soon,

[…] How To Use A Budget Planner In College […]